Transparent, All-In Pricing:

Wealth Management Without the Guesswork

At Asset Financial Planners, we believe that trust begins with transparency. One of the biggest hurdles in the financial industry is the "hidden fee" culture—layers of costs that eat away at your returns without you ever seeing a line item.

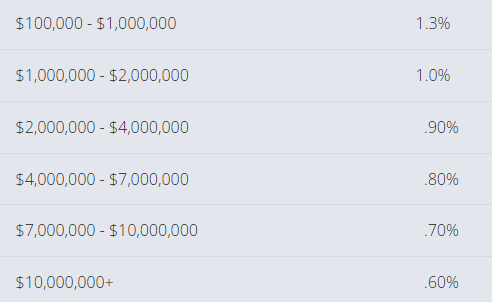

We do things differently. We utilize a tiered flat-fee schedule that is bundled to include all of our core services. When you partner with us, your fee doesn't just cover a stock picker; it secures your custodian, investment platform, professional portfolio manager, and our local financial advisor.

Our "All-In" Advantage

What truly sets us apart is our commitment to low-cost implementation. While many firms charge a fee on top of expensive mutual funds with high internal costs, we primarily use low-cost ETFs.

- Our Advisory Fee: Starts at 1.30% for accounts under $1MM.

- Average ETF Expense Ratio: Only 0.14%.

- Your Total "All-In" Cost: 1.44% (for assets under $1MM).

By keeping internal fund expenses low, more of your money stays in your portfolio, working for your future.

Why a Tiered Fee Structure?

As your wealth grows, your financial complexity increases, but your percentage rate decreases. This "economies of scale" model helps ensure that our interests are perfectly aligned with yours: as your portfolio grows, you move into lower fee tiers.

What You Get for Your Investment

Your bundled fee provides more than just a monthly statement. It gives you access to the Freedom 360 Process, which includes:

- Tax-First Planning: Ongoing analysis to minimize federal tax liability.

- Retirement Red Zone Prep: Specialized guidance for the 5–10 years before you exit.

- Local Accountability: A physical office in Cheyenne where you can meet your advisor face-to-face.

Commonly Asked Questions

What exactly am I getting for the "All-In" fee?

Your fee covers much more than just a portfolio manager; it covers your entire Financial Ecosystem. At Asset Financial Planners, our bundled fee includes:

- The Freedom 360 Process: Ongoing, comprehensive financial planning.

- Tax-First Oversight: Continuous monitoring for tax-loss harvesting and Roth conversion opportunities.

- Institutional Custody: Safe keeping of your assets with a top-tier national custodian.

- Local Advisor Access: Unlimited access to our Cheyenne office for face-to-face reviews and strategy sessions.

What if I just want a one-time financial plan?

While we specialize in ongoing fiduciary relationships, we understand that some families are looking for a standalone roadmap. For these situations, we offer a project-based financial planning fee. This allows us to build your comprehensive Freedom 360 plan—addressing your "Retirement Red Zone" readiness and tax-first strategy—without the requirement of ongoing investment management. If you later decide to have us manage your assets, we often credit a portion of that planning fee toward your first year of advisory services.